how to file back taxes yourself

Get The Tax Expertise You Deserve With HR Block. If you are self-employed you will not be able to get a copy of your income earned from the IRS.

How To Get Maximum Tax Refund If You File Taxes Yourself

Have Confidence Knowing You Did Your Taxes Right w A Final Review From Real Tax Experts.

. Since tax laws change year to. Free Federal 1799 State. Ad Even complex federal returns pay no more than 179.

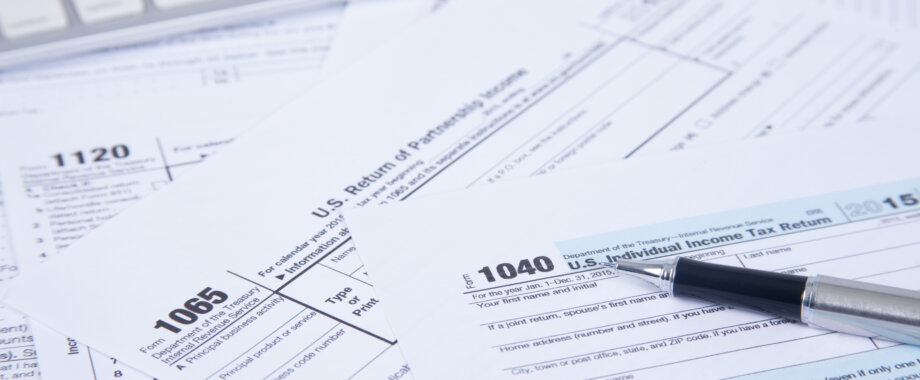

Ad Fill out form to find out your options for FREE. Ad You Can Still File Tax Returns For Past Years. Form 1040 This should be familiar to most of you.

Ad Get Free Online Tax Filing And Your Max Refund Guaranteed With HR Block Free Online. 5 Step 2 Prepare and file your tax returns. Ad Connect With A TurboTax Live Expert To Help You File Your Taxes Or Do Them For You.

You Can Still File Tax Returns for Past Years. Get our online tax forms and instructions to file your past due return or order them by calling 1-800-Tax-Form 1-800-829-3676 or 1-800-829-4059 for TTYTDD. Maximize Your Tax Refund.

When it comes time to file you will use those documents to fill. Filing a tax return for a previous year isnt as hard as you may think but it does require a few steps. Ad Fill out form to find out your options for FREE.

The IRS may. How to file tax returns for previous years. Heres what to know about filing back taxes.

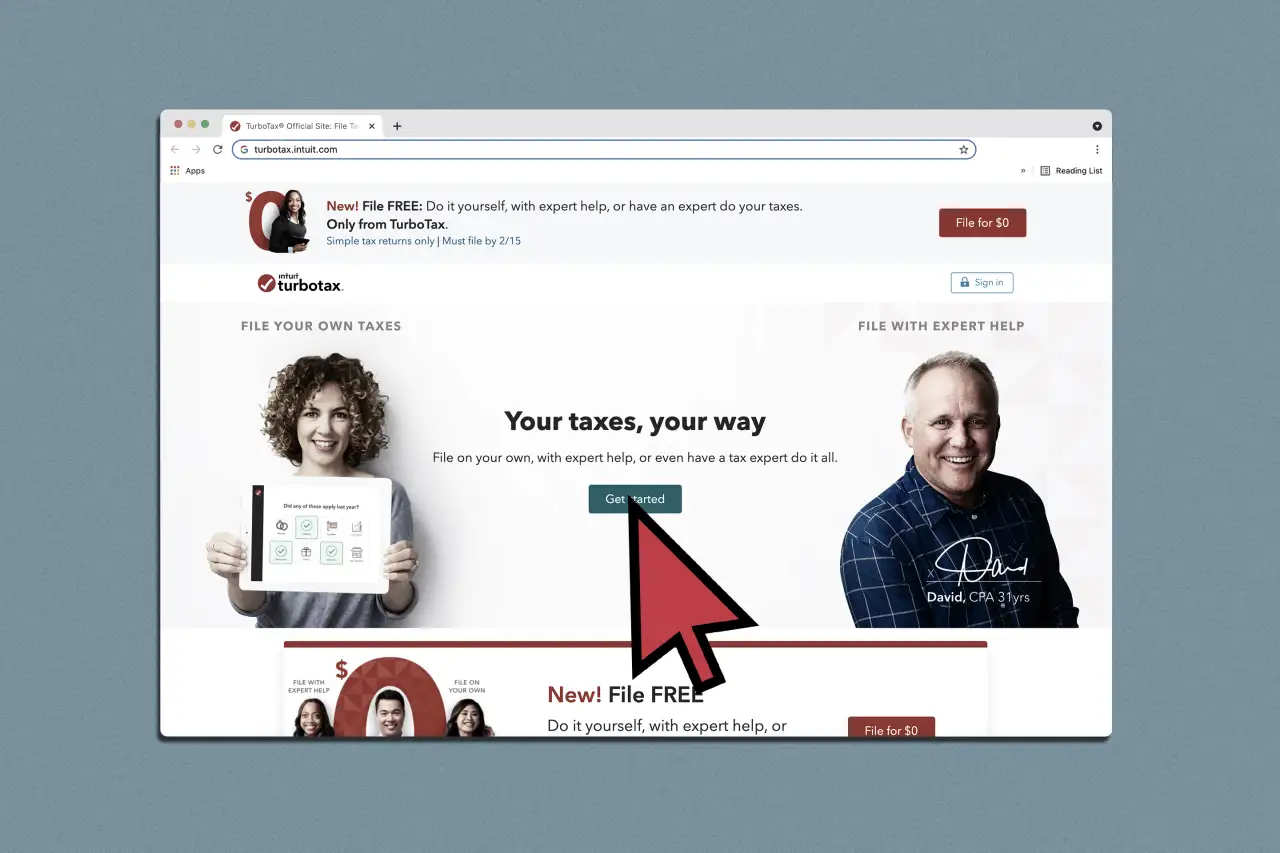

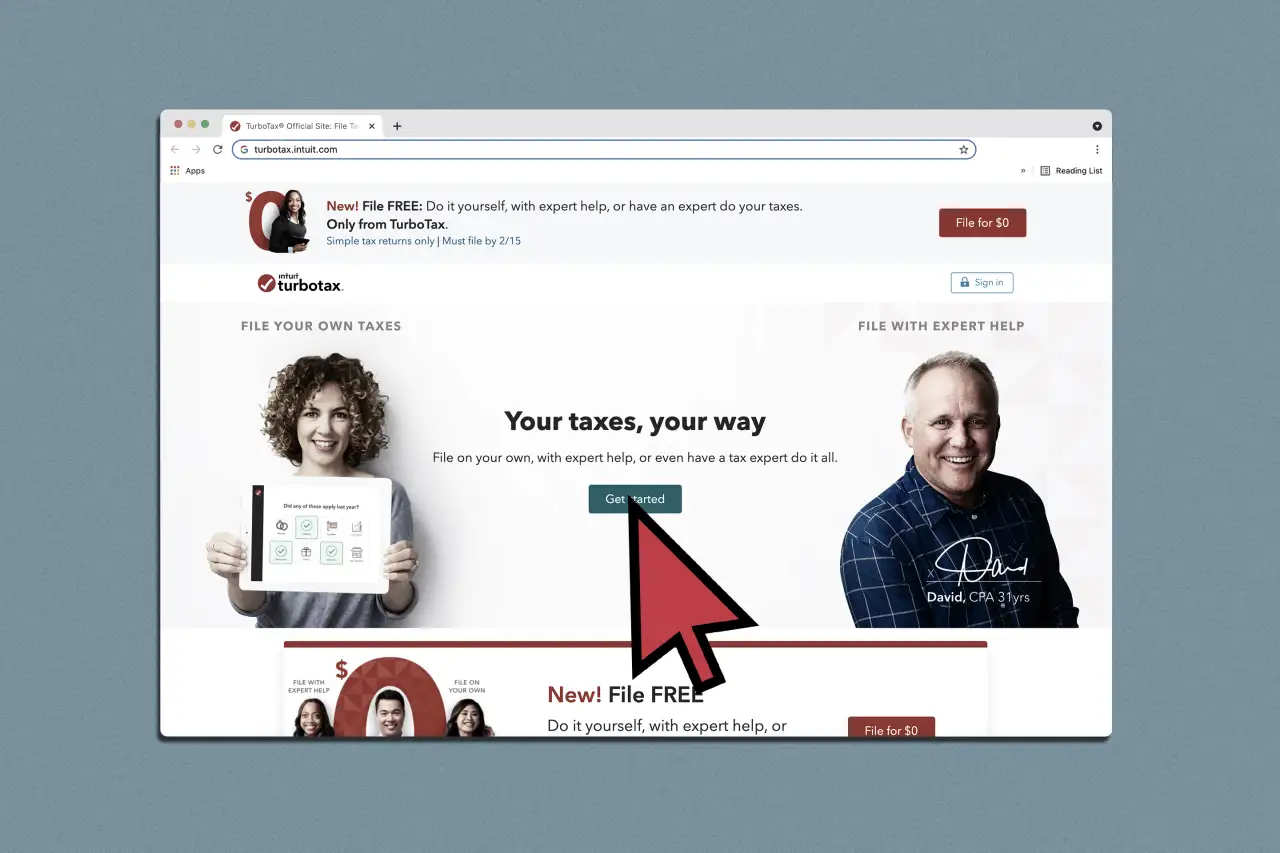

If you want to tackle filing your back taxes by yourself choose a reputable tax software companyto assist you. Ad Prevent Tax Liens From Being Imposed On You. You cant file your tax return until youve received a Form W-2 or Form 1099 from every place you have worked during the year.

The IRS charges a fee for the installment. You can also file IRS Form 9465 the Installment Agreement Request with your tax return regardless of how much you owe. For example if you did not file 2015.

Determine how youll file your back taxes. If youre doing your taxes yourself these are the forms youll have to deal with on your annual return. Keep your Federal tax return fees low.

Download the proper tax forms for the year. 4 Step 1 Get your wage and income transcripts from the IRS. 3 Should you file your tax returns if you cant pay the taxes.

1040 is the form that. E-File Options including Free File If you mail a paper Form 1040 US. Start Your 2022 Tax Return Today.

Be prepared to pay fees or penalties. Individual Income Tax Return PDF it can take 6 to 8 weeks to process your return. CPA Professional Review.

Free Federal only 1799 State.

How To File Your Small Business Taxes Free Checklist Gusto

Turbotax Review 2022 Pros And Cons

How To File Taxes For Free In 2022 Money

How To File An Extension For Taxes Form 4868 H R Block

3 Ways To File Just State Taxes Wikihow

How Long Does It Take To Get A Tax Refund Smartasset

Tax Season 10 Tips For Doing Your Taxes Yourself

How Do I File Returns For Back Taxes Turbotax Tax Tips Videos

Unfiled Tax Return Information H R Block

File Your Own Taxes Online Turbotax Official

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Can The Irs File A Return For Me Yes But It S Not Pleasant H R Block

The Owner Operator S Quick Guide To Taxes Truckstop Com

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

How To File Taxes For Free Turbotax 2022 Free File Change Money

Ways To File Taxes For Free With H R Block H R Block Newsroom